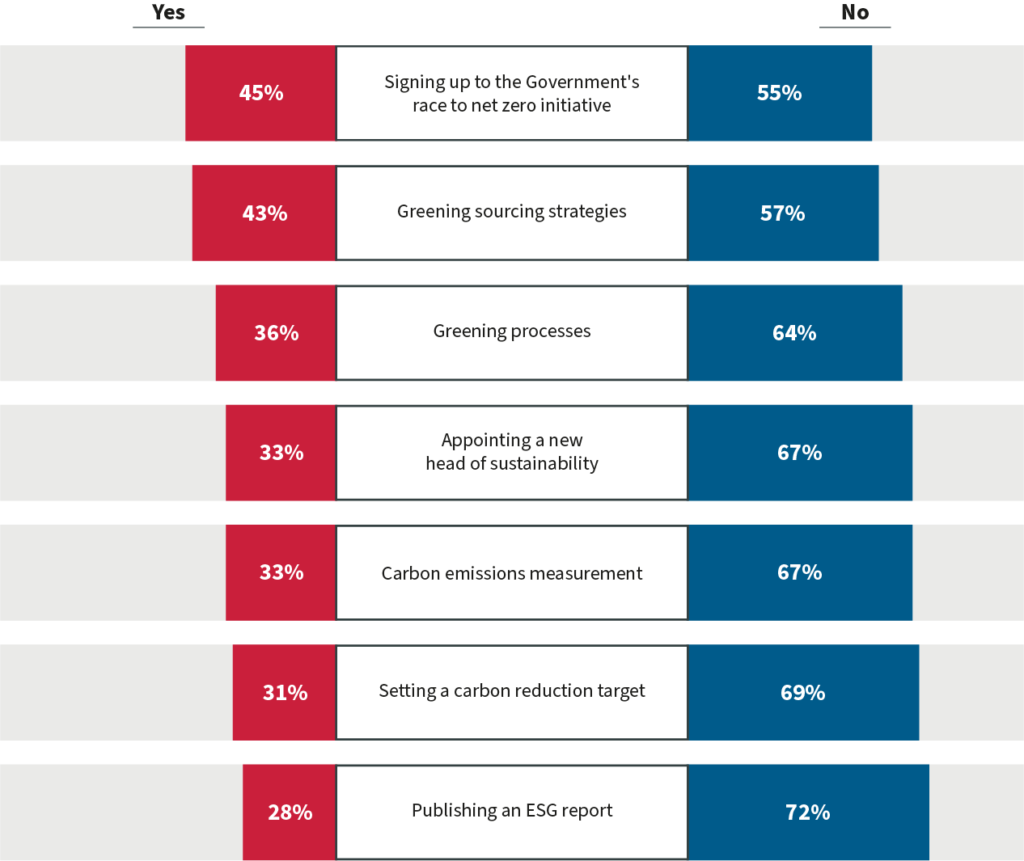

The Future of Packaging: Balancing Sustainability, Cost, and Innovation

We will explore how businesses can more effectively navigate an evolving market landscape by critically evaluating their existing packaging strategies

and exploring innovative alternatives.