Webinar – Robust inventory management: The key to thriving in uncertainty

In the face of increased operational pressures, we explore how manufacturers can embed a robust approach to inventory management to keep production lines moving.

We deliver accelerated EBITDA growth and multiple build to drive increased EV through operational cost reduction and transformation. Vendigital has an established track record of supporting private equity firms across the end-to-end investment lifecycle – partnering with organisations globally to drive a step change in EBITDA improvement and cash generation either at a portfolio or business level.

Our teams understand how to swiftly identify value and have the breadth of industry knowledge and capabilities to unlock it – acting fast on value creation, improving operational performance and providing specific operational insights on a deal or portfolio company. Our deep consulting and operational expertise combine with our digital platform to create a single version of the truth, from which we generate and embed investment specific and cross portfolio insights. These insights allow our 1,300 experts across 35 countries to deliver tangible value quickly.

The opportunities we see for our private equity clients

From our international experience of working within private equity we see common opportunities for both PE houses and portfolio businesses, which stem from the overarching imperative of driving EBITDA improvements at pace. We utilise our frameworks, methodologies and value creation mindset to:

• Accelerate direct and indirect cost improvements across cash, working capital and performance improvements – taking a data first approach that identifies target incentives, prioritising both the speed and scale of benefits

• Drive through cost and value engineering improvements across products and services within portfolio companies

• Embed sustainable benefits within portfolio businesses, with the management team able to monitor the achievement of benefits through a single insights platform

• Navigate complex stakeholder management issues whilst upskilling the management team either through supporting their development or providing interim experts with the capability and industry expertise to supplement in-house teams

Accelerate EBITDA growth

By bringing together our multi-disciplinary consulting experience with our digital platform, we are able to deploy data-driven operational insights to embed measurable and sustainable cost benefits within specific investments and at a portfolio level.

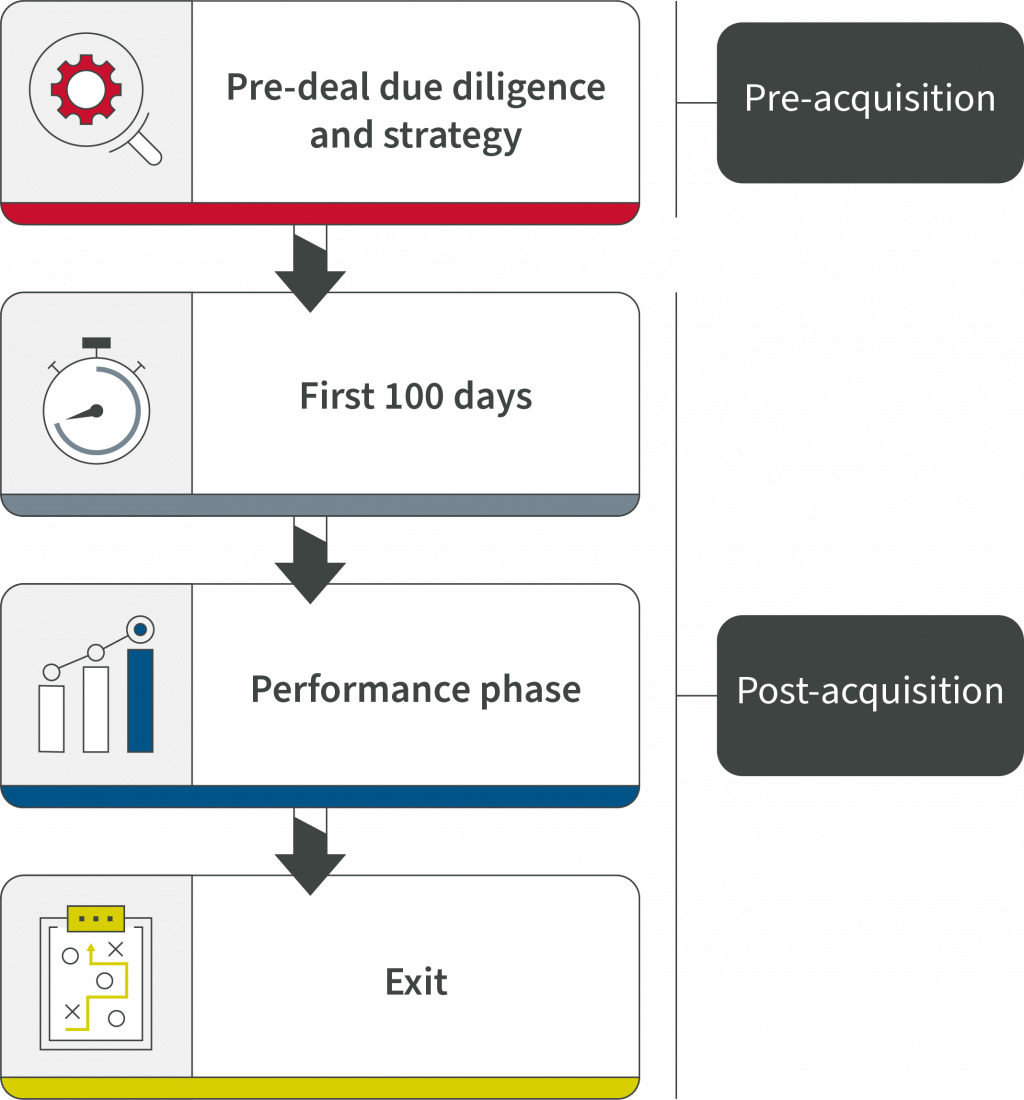

We support PE houses and owner operated businesses at both pre, during and post-acquisition stages:

• Pre-deal due diligence and strategy – by providing reliable, complete data we enable clients to have more confidence in the bidding process

• First 100 days – supporting you to execute your 100-day plan and deliver quick win cost saving opportunities

• Performance phase – executing the cost transformation plan and turning around off-plan investments to improve product margins, including through the provision of expert resource

• Exit – helping you to develop a clear roadmap and enhance value at sale, including supporting the vendor due diligence process

Our initial savings assessment is completed free of charge and we engage by deploying a cost neutral approach; we are low risk for both the PE house and portfolio company; we maximise both cash and EV; and we upskill management teams to ensure the benefits are retained within portfolio companies on a long-term basis.

Get in touch to find out how we can partner with you to achieve a step change in EBITDA improvement and drive enterprise value across your portfolio.

WHATEVER YOUR REQUIREMENTS, WE PROVIDE SOLUTIONS TO FIT YOUR BUSINESS NEEDS…

In the face of increased operational pressures, we explore how manufacturers can embed a robust approach to inventory management to keep production lines moving.

In this webinar our panellists discuss how to get visibility of your carbon emissions by breaking down your manufactured products, and why cutting carbon in your operations can also help you cut cost.

With product innovation flourishing, manufacturers could be forgiven for innovating first and thinking about whether their value chain is capable of bringing it to market later. Yet taking this approach could be selling themselves short.

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish. Read More

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| wpl_user_preference | vendigital.com | WP GDPR Cookie Consent Preferences | 1 year | HTTP |

| wpl_viewed_cookie | vendigital.com | This cookie stores information about your cookie consent state. | 1 year | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _gcl_au | vendigital.com | Used by Google AdSense for experimenting with advertisement efficiency across websites using their services. | 3 months | --- |

| __hstc | vendigital.com | Hubspot marketing platform cookie. | 6 months | HTTP |

| __hssrc | vendigital.com | Hubspot marketing platform cookie. | 52 years | HTTP |

| __hssc | vendigital.com | Hubspot marketing platform cookie. | Session | HTTP |

| _obid | vendigital.com | This cookie is set when a user lands on the site, containing a unique ID relating to the email that was clicked on. | 365 days | HTTP |

| _obid_visit | vendigital.com | This is used to identify a site session across multiple pages. | Session | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga | vendigital.com | Google Universal Analytics long-time unique user tracking identifier. | 2 years | HTTP |

| _gid | vendigital.com | Google Universal Analytics short-time unique user tracking identifier. | 1 days | HTTP |

| _gat_gtag_UA_29623111_7 | vendigital.com | Used to analyse visitor browsing habits, flow, source and other information. | Session | --- |

| IDE | doubleclick.net | Google advertising cookie used for user tracking and ad targeting purposes. | 2 years | HTTP |

| mp_a36067b00a263cce0299cfd960e26ecf_mixpanel | vendigital.com | Allow us to analyse how users use our site | 1 year | HTTP |

| _gcl_aw | vendigital.com | --- | 90 days | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| hubspotutk | vendigital.com | HubSpot functional cookie. | 6 months | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _GRECAPTCHA | www.google.com | Helps protect our clients and our systems from cyber spam and abuse. The information collected in connection with your use of the service will be used for improving reCAPTCHA and for general security purposes. It will not be used for personalised advertising by Google. | 6 months | --- |

| ppwp_wp_session | vendigital.com | --- | Session | --- |

| test_cookie | doubleclick.net | A generic test cookie set by a wide range of web platforms. | Session | HTTP |

| pnctest | vendigital.com | This is set by a third party library of Pubnub to test if cookies are supported by the browser. | 2 years | HTTP |

| traincalc | vendigital.com | Supports the UK Train Profitability Calculator advanced functionality | 3 months | HTTP |

| rs6_overview_pagination | vendigital.com | Cookie is set by Slider Revolution, tracks downtime and other browser related issues. | Session | HTTP |