Going beyond lean manufacturing

The UK’s aerospace industry has seen significant improvements in productivity but the truth is that much more could be achieved by accelerating the adoption of digital technologies and enriching the skills base.

Paul Adams is a Director and Aerospace & Defence sector specialist at Vendigital. He recently shared his insights with Royal Aeronautical Society.

It seems that examples of supply chain disruption are all around, with OEMs in the civil and defence industries finding that managing delays and shortages has become part of everyday life. What started out as a symptom of the post-Covid ramp-up is now part of the new order, but what is causing all this disruption and will it ever end?

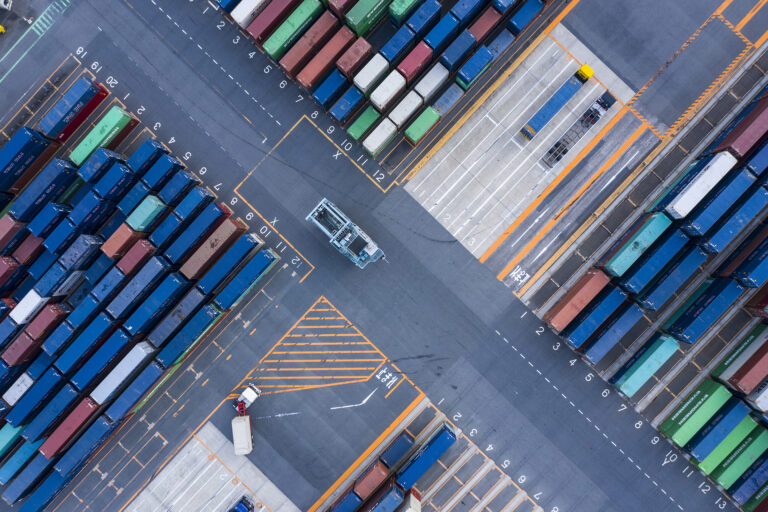

After the longest period of stability for aerospace and defence supply chains since World War II, things have taken a different turn. Increased geopolitical instability brought on by rising global trade tensions and the wars in Ukraine and Gaza have caused global supply chains to fracture, bringing challenges for many industries. The latest manifestation of this is the Red Sea crisis, where escalating tensions between the US and Iran-backed Houthi rebels are forcing all major container shipping lines to make a 3,500-mile diversion around the Cape of Good Hope to access European ports.

For manufacturers, increased global instability has caused commodity prices to rise to record levels and introduced significant cost volatility. Add to this the impact of post-pandemic skills shortages and the global shortage of titanium, much of which is sourced from a supplier in Russia, and it’s easy to see why aerospace and defence supply chains have been under so much pressure. Some manufacturers have been forced to push back deadlines and cancel deliveries. For OEMs, the significant investment made in ramping up production, combined with a stop-start supply chain, has proved especially challenging.

The root cause of the extensive supply chain fracturing is, of course, globalisation. Prior to 2020, there was a sustained push by manufacturers in Western economies to globalise supply chains and focus on sourcing raw materials and components from low-cost countries. Supply chains in the aerospace and defence industry lengthened as a result, making them more susceptible to global instability. Now, with global supply chain disruption continuing, manufacturers are looking to localise or regionalise production where they can and adapt their sourcing strategies to increase resilience.

Defence sector growth: opportunity or risk?

Both the civil and defence industries are experiencing exceptional growth in demand. Growth in the civil sector is linked to an upturn in passenger demand for flights. According to the International Air Transport Association (IATA), an estimated 4.7 billion people are expected to take flights in 2024, more than the 4.5 billion passengers recorded in 2019. The production lag-effect caused by pandemic-related shutdowns is also having an effect. Growth in the defence sector on the other hand is driven mainly by Russia’s invasion of Ukraine, as well as increased geopolitical tensions and instability. The GCAP Program and AUKUS tri-National agreement, are indicators of heightened focus on the defence sector as countries around the world look to bolster their military capabilities.

While growth brings opportunities, there are also significant risks for aerospace and defence manufacturers, and it’s becoming clear that the current climate of geopolitical uncertainty and cost volatility is not going away anytime soon. In the UK, some analysts had expected indicators to be improving by now – with the high rate of inflation and interest rates falling back more quickly than they have and skills shortages less evident due to investment in training and development programmes. However, both factors remain a major cause of concern. Manufacturers are also aware that today’s Generation Z workers are vital to the future of the industry, and they must stay focused on recruiting and retaining talented, young people to remain competitive. It is the digital aptitude of this fresh influx of workers and their interest in AI, coding and data science that will enable OEMs and sub-tier suppliers to make the most of advanced technologies and boost their market position.

Duopoly in distress, but will it last?

Another destabilising factor for aerospace and defence supply chains has been a run of safety issues for one of the industry’s dominant aircraft makers – Boeing. The Airbus-Boeing duopoly, which has prevailed since the 1990s and driven so much industry competition over that time, has lost its equilibrium. While Boeing is doing the right thing by taking responsibility and addressing its problems openly, in an industry where long-term programmes are standard, there is a need to act quickly to avoid missing out on ramp-up opportunities. For OEMs and their supply chains, even if the current imbalance is temporary, it could bring unwanted side effects such as increased demand uncertainty and higher prices.

To take advantage of rapid growth in the defence sector, OEMs and their sub-tier supply chains should focus on innovation and stay open to new ideas and ways of doing things. Key to this is industry collaboration, particularly in areas such as supply chain inventory management and new product design and development. Digital technologies, such as AI systems and digital twins, also have a role to play by enabling companies to speed up innovation processes and achieve the seamless integration necessary to deliver value-driving efficiencies.

Smoothing out the fractures

Effective Product Lifecycle Management, which aims to nurture an innovation from design stage through to production, distribution and end-of-life planning, can also fast track innovation pipelines and enable manufacturers to be first to market with new or improved products. R&D projects in both the civil and defence industries are sometimes constrained by the long-term nature of production programmes, which means there is an increased risk of technologies becoming obsolete or non-functional during their lifespan. To mitigate this risk, forward-looking R&D teams are adopting agile design methods, such as those applied in the software industry, which build in allowances for multiple in-life upgrades.

For the first time in years, OEMs serving the global defence industry have an opportunity to position themselves as innovation leaders; establishing collaborations and developing innovative products and processes that will be taken up by civil aircraft designers too. This is an opportunity not to be missed and it is important to look beyond the current disruption.

While supply chain fractures have opened up across the aerospace industry, strong demand in both the civil and defence sectors has created a climate of positivity. OEMs and sub-tier manufacturers that push for continuous improvement by boosting supply chain resilience and operational efficiency, at the same time as embracing the power of AI, automation and digital tools, could gain a competitive advantage. When weighing up tech transfer opportunities, they should avoid following customer demands and challenge decision-making processes to ensure they invest in ways that will deliver the most long-term benefit.

At a time of rapid industry expansion and seemingly unending instability, decisions designed to facilitate end-to-end supply chain integration and positive industry collaborations are likely to bring the greatest commercial reward.

Sign up to get the latest insights from Vendigital

Optimise your supply chain

Related Insights

The UK’s aerospace industry has seen significant improvements in productivity but the truth is that much more could be achieved by accelerating the adoption of digital technologies and enriching the skills base.

Manufacturers need to collaborate closely with suppliers to mitigate the impact of shocks and supply chain disruptions.

The boom in Generative AI is creating new opportunities for aerospace and defence sector manufacturers. Used correctly, GenAI capability can help to optimise production processes, improve supply chain resilience, ringfence knowledge and reduce costs.

Subscribe to our newsletter