Increasing capacity and meeting decarbonisation goals – can it be done?

We discuss the cost and infrastructure considerations of switching to an all-electric fleet of off-highway vehicles.

Dominic Tribe is a Partner and Automotive sector specialist at Vendigital. He recently shared her insights with Automotive purchasing and supply chain.

The latest data on new vehicle registrations in the UK shows that sales of electric vehicles – both battery electric and plug-in models – are now rising at a record rate, and this segment of the market is set to be the main driver of sales in 2023.

The Society of Motor Manufacturers and Traders (SMMT) has recently released figures for new car registrations for the whole of 2022, which show a 40% increase in the volume of battery EV sales compared to 2021. The total number of battery electric and plug-in hybrid vehicles now registered for use on Britain’s roads is 128,000. Sales of battery electric vehicles represented 16.6% of the new car market, while plug-in hybrids represented a further 6.3%, bringing the overall market share for the sale of new plug-ins to nearly 23%. Interestingly, the majority of new car registrations in the UK were private owners, but EVs were largely bought by fleet and business owners (66.7%) and were responsible for 74.7% of EV volume gain in 2022.

The continued growth in EV sales comes despite a slowdown in the overall number of new car registrations in 2022, which fell by 2% to 1.61 million units – the lowest level since 1992.

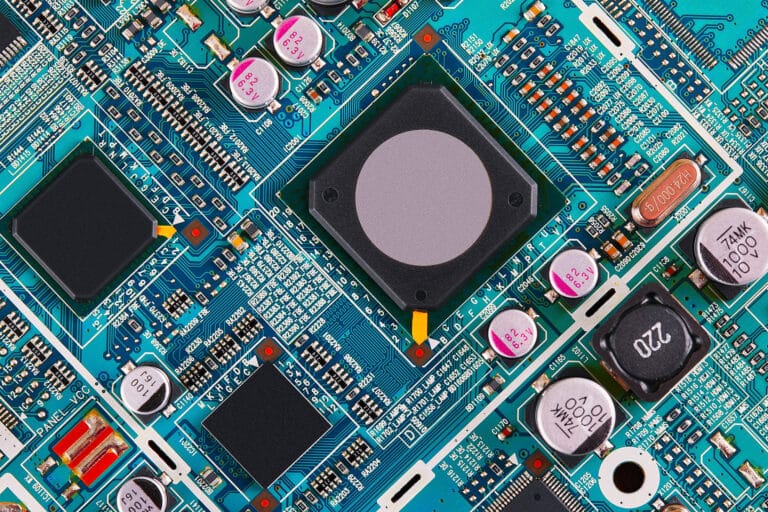

The dip in new car registrations last year has largely been blamed on pandemic-related parts shortages. In particular, problems linked to the availability of semiconductors have impacted EV production, leading to lengthy waiting times for new orders. While this problem hasn’t gone away, EV makers have adapted their sourcing strategies to improve their resilience in this area and there are signs that lead times are starting to reduce. Research conducted recently by Electrifying.com suggests that the average waiting time for a new electric vehicle is now 28 weeks, down from 35 weeks in October last year.

Looking forward to 2023, demand for EVs in the UK is expected to continue to increase – rising to 26.7%, according to the SMMT. At some stage however, growth could start to plateau and auto makers that have secured a significant share of the market by this point will be the dominant players and some market consolidation is likely. Making the most of this period of rapid growth is important for all EV makers – from the new EV platforms through to the established vehicle manufacturers.

With the cost of living crisis impacting consumer confidence at the start of 2023, decisions about which EV to purchase are more likely to be cost driven and achieving cost parity is a key concern for manufacturers. Some OEMs, like Toyota, are avoiding BEV options for their smaller products where the greatest price disparity exists. Greater focus on battery tech innovation could bring results in this area, enabling some price reductions. Even with battery production capacity set to increase throughout 2023, rising costs could erode some of this cost benefit. In the medium term, the cost of EVs will need to come down to make them more attractive to mainstream motorists, and marketing focused on selling the benefits of EV versus ICE vehicle ownership could also be improved to highlight the cheaper running costs.

Another key concern for motorists when weighing up whether to buy a new EV or ICE vehicle is the available charging infrastructure. While 8,700 new public electric chargers were installed in 2022, according to data from Zap-Map, this is still well below the volume needed to meet the demands of a fast-growing market. Despite there being about 37,000 charging points across the UK, they tend to be concentrated in pools – typically in cities and areas with a higher socio-economic status.

The Government’s EV Infrastructure Strategy has forecast that the UK will need between 300,000 and 720,000 public charging points by 2030. This is obviously going to be a major undertaking, and as experts at the SMMT have recently explained, meeting the lower end of this target would require 100 new chargers to be installed every day.

With the aim of addressing the infrastructure challenge, a number of EV makers are investing in innovation programmes to find new charging technologies, including solutions such as Ubitricity’s lamppost charge points, which allow people living in homes without driveways to possibly own an EV. Using cost reduction strategies to support investment in R&D initiatives is becoming more important, particularly for established auto makers that may still be producing both ICE and EV ranges. Wireless in-road charging systems, which could extend the range of EVs by allowing them to charge as they travel along major routes, are also being developed by Electreon, and a trial is currently underway on an Autobahn route in Balingen, Germany.

For EV makers, improving operational efficiency, optimising supply chain management and using cost reduction projects to support investment in collaborative R&D, could accelerate their growth strategies in the year ahead.

Sign up to get the latest insights from Vendigital

Need an automotive sector specialist?

Related Insights

We discuss the cost and infrastructure considerations of switching to an all-electric fleet of off-highway vehicles.

EV makers in the UK and Europe are warning that Zero Emission Mandates are simply not doable and subdued levels of demand could force them to close factories. Should the industry embrace Chinese capability before it’s too late?

In our latest report we examine the impact of power electronics and the importance of inverters in EV manufacturing.

Subscribe to our newsletter