Increasing capacity and meeting decarbonisation goals – can it be done?

We discuss the cost and infrastructure considerations of switching to an all-electric fleet of off-highway vehicles.

Sheena Patel is a Director and Automotive sector specialist at Vendigital. She recently shared her insights with Automotive World.

As if progressing product-specific decarbonisation plans wasn’t challenging enough, electric vehicle (EV) makers must now ensure they have a deep-level understanding of the sustainability and traceability of each battery pack they source too. However, preparing ahead of time could bring opportunities and smooth the way to compliance.

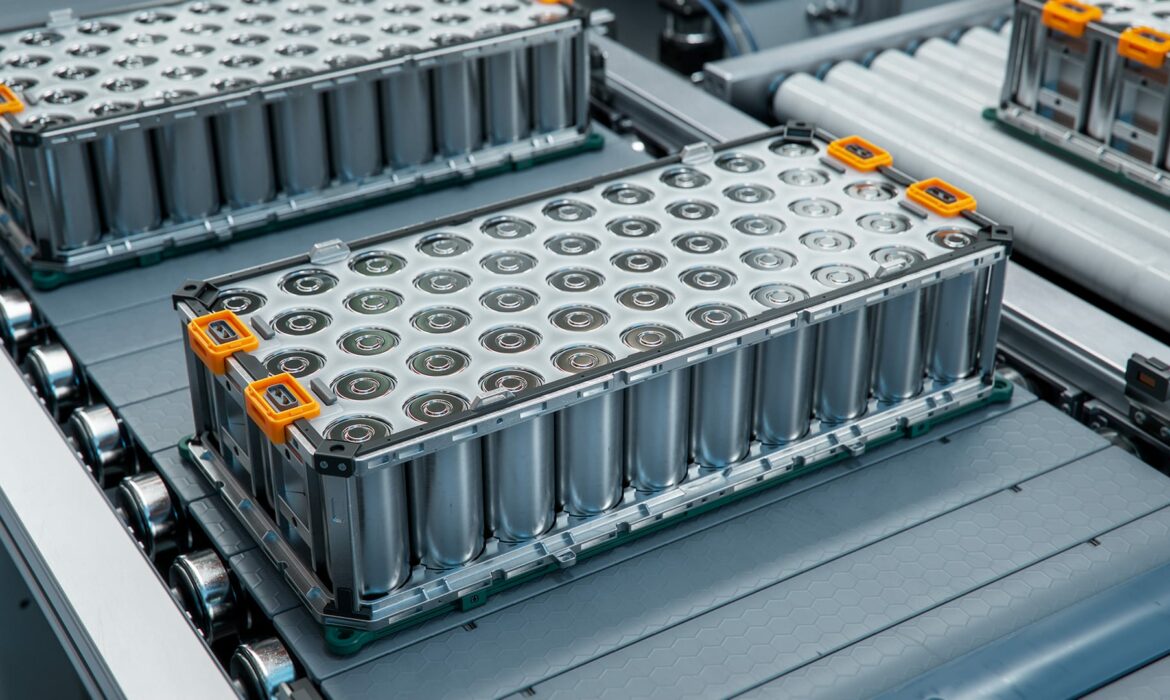

From February 2027, digital passports for batteries over 2kWh will have to be provided to customs officials for each UK-made EV crossing the channel. These passports are a requirement of the EU Battery Regulation, which aims to increase transparency and sustainability in the battery value chain. To complete the new passports, EV makers will be required to disclose lifetime carbon emissions data for each battery along with details of the materials used, how they are sourced and any recycled content. The aim is to encourage manufacturers to use more recycled content in the run-up to 2035, ahead of the ban on the sale of new internal combustion engine (ICE) vehicles in the UK and Europe.

Make use of guidance

The precise detail of the information that will have to be shown in the new battery passports is not yet known. However, the Battery Pass Consortium has recently published technical guidance and a software demonstrator to assist vehicle makers in getting started. Drawing together the requirements of various strands of EU legislation, the new guidance sets out a proposed framework and recommendations, with the aim of establishing a standardised approach. This approach is needed as the new battery passport is considered a forerunner to the incoming Digital Product Passport (DPP), which is likely to be introduced for other industry sectors in the future.

In addition to increasing visibility of greenhouse gas emissions (GHG) generated from the manufacture and use of EV battery packs and other industrial batteries, the new passport will reveal more information about how raw materials are sourced and where from. For EV makers, this could bring reputational risks if it is found, for example, that lithium or cobalt is being mined in an area of the world where modern slavery is practiced. With greater transparency, comes greater responsibility for EV makers to ensure that their end-to-end supply chain is operating ethically and sustainably.

Sharing knowledge

There are some examples of best practice for EV makers to adopt as they prepare for the new battery passports. Norway was the first country in the world to introduce a Transparency Act, which requires any company selling products and services there to demonstrate that human rights and decent working conditions are respected in their operations and supply chains. Car makers exporting vehicles to Norway will therefore already have knowledge of what achieving compliance looks like and some may already be applying this due diligence more widely.

Data science pioneers are also exploring ways to support EV makers’ preparations for the new battery passport and other EU regulatory requirements. For example, Siemens has been working with leading car makers and industry bodies to produce a decentralised, open data ecosystem for the automotive industry, facilitating transparency and traceability across end-to-end supply chains. The digital supply chain platform, known as Catena-X, enables vehicle manufacturers and OEMs to apply due diligence to their sourcing strategies and map where GHG emissions are coming from.

Early action is needed

Even though the new battery passports aren’t due to be introduced until 2027, EV makers should start preparing now. As part of the EU Battery Regulation, new sustainability assessments will become a requirement in February 2025, requiring battery manufacturers to declare carbon emissions data for each battery they produce according to batch and site of manufacture. This data must be third-party verified and made publicly accessible on the internet. Further rules related to the end-of-life management of batteries will become a requirement in August 2025.

The level and depth of information required to comply with the EU Battery Regulation, including the new digital passport, is daunting for all manufacturers, but perhaps more so for EV makers. They are currently facing strong competition from a rising tide of Chinese imports, which means adapting to comply with new regulations is more challenging. The scale of the changes required also means that most EV makers will need to draw in external support. Doing so early could play out in their favour, however, if rival manufacturers prove to be slower on the uptake.

How to prepare

Early procurement involvement also gives EV makers a chance to plan ahead. Instead of developing a new product design and then sourcing components to suit, procurement professionals can play a more strategic role. For example, they could help the business to decide whether it will be better to make or buy critical components, such as battery packs, in the future, and undertake due diligence so they are ready to act when phase two and three battery technologies become available. Understanding the risks and making sure that the business has access to market information and pre-approved suppliers that meet due diligence criteria will enable the business to respond to market or regulatory changes in an agile way, whilst building in transparency from the start.

With demand for EVs growing rapidly and technologies still developing, EV makers in the UK and Europe know they must get products to market quickly to compete with the Chinese imports which are currently flooding their markets. Whereas in the past, vehicle manufacturers and OEMs might have been unwilling to share their intellectual property and supply chain information with competitors, consortiums and joint ventures are now popping across a number of rapidly-growing markets. For example, Renault has signed a joint venture agreement with Chinese-owned Geely to form a business to supply powertrains and to develop zero and low carbon technologies. In the US, GM has recently announced joint ventures with battery cell maker LG Chem and EV maker and infrastructure provider Nio.

Increased industry collaboration inevitably brings opportunities for enhanced data visibility, which could be leveraged through the application of AI. For example, AI systems could provide an aggregated view of sources of supply and enable EV makers to make informed decisions about risk factors which could disrupt production. The predictive powers of AI could enable car makers to spot patterns in sourcing decisions that bring an increased risk of disruption so they can take action at an early stage. Applying AI in this way could even help to prevent the type of disruption caused recently when Porsche, Bentley and Audi cars were impounded at US ports over a legal issue affecting a single subcomponent.

Currently, many OEMs and EV makers lack supply chain visibility. They are reliant on declarations from Tier 1 and 2 suppliers, and while some of this information is validated, much of it isn’t. Further down the chain, the picture becomes even less clear. There is no ‘universal truth’ and striving for it through the normal channels of supply chain communication would be a time-consuming and costly undertaking. Instead, developing an AI-based model trained on a wealth of industry and other third-party data to support supply chain transparency and sustainability could give manufacturers a reliable view of their end-to-end value chain much more quickly and cost-efficiently.

Look beyond passports

In addition to early procurement involvement to increase supply chain visibility, EV makers need a strategic plan that looks beyond the introduction of new battery passports and other EU regulations.

Focusing on supplier engagement and data gathering now could decrease risk and bring opportunities in the longer term. For EV makers looking to launch or scale new ranges, it may not be possible to catch up with Chinese counterparts and Tesla, but it may be possible to build a value chain that is more secure and resilient in the long term. Data is the key that could help to unlock an AI-enabled advantage.

Sign up to get the latest insights from Vendigital

Accelerate your electrification journey

Related Insights

We discuss the cost and infrastructure considerations of switching to an all-electric fleet of off-highway vehicles.

EV makers in the UK and Europe are warning that Zero Emission Mandates are simply not doable and subdued levels of demand could force them to close factories. Should the industry embrace Chinese capability before it’s too late?

In our latest report we examine the impact of power electronics and the importance of inverters in EV manufacturing.

Subscribe to our newsletter