Introduction

Since the European Commission pre-released a provisional increase in tariffs on Chinese EV imports in June, ranging from 17.2% to 38%, a vote of EU countries has revealed a divided situation with 10 in favour, 5 against, and 12 abstentions. The EU commission has also stated that it is “open to a mutually acceptable solution”.

But while a path to agreement is likely to take time, it could be a win-win for the EU and China.

Contents

About the Author

Beibei Sun is a managing consultant and automotive sector specialist at Vendigital. She has a wealth of experience in procurement transformation, strategy, execution and innovating business models with digital methods. years of experience in procurement

transformation, strategy and execution.

Don’t Miss Out

Sign up to get the latest insights from Vendigital

What could a win-win look like

European Union

• EU is expected to fall short of its net zero target by 2050 at 684 million tonnes’ emission p.a., based on projection of Wood Mackenzie. Chinese EV could help save the plan.

• EU needs to preserve and grow native automotive industries, and Chinese EV could support it with technology transfer, labour upskill and supply chain upgrade in a joint venture.

• EU needs to manage transition from ICE to electrification with a counter balance to fall in government revenue – notably from 1 April, EV drivers in the UK will need to pay for road tax. Chinese EV could alleviate some pressure by generating jobs from manufacturing locally and embedding with local ecosystem set-up.

China

• Chinese EV needs a new market to make reasonable margins. Chinese EVs are extremely price competitive not because of positive policies, but domestic competition. The fact that the public subsidies are phasing out accentuates the need of Chinese EV to look for fresh customers.

• Among all overseas markets, EU stands out because of its relative openness (compared to US), high spending power (relative to Southeast Asia or South America), and readiness to adopt EV.

• In order to embed into EU market, as well as truly becoming a global brand, Chinese EVs’ cannot hide the workings behind the national border. An inevitable “shortcut” is to build in the EU and strong local partnership, which echoes well with the EU needs.

The challenges faced

While opportunities exist, there will also be challenges for a ‘sell here, build here’ operating model including:

01 - Manufacturing footprint strategy

01 - Manufacturing footprint strategy

02 - Supply chain strategy

02 - Supply chain strategy

03 - Connection with the supply base

03 - Connection with the supply base

04 - Sales and aftersales network

04 - Sales and aftersales network

01 – Manufacturing footprint strategy

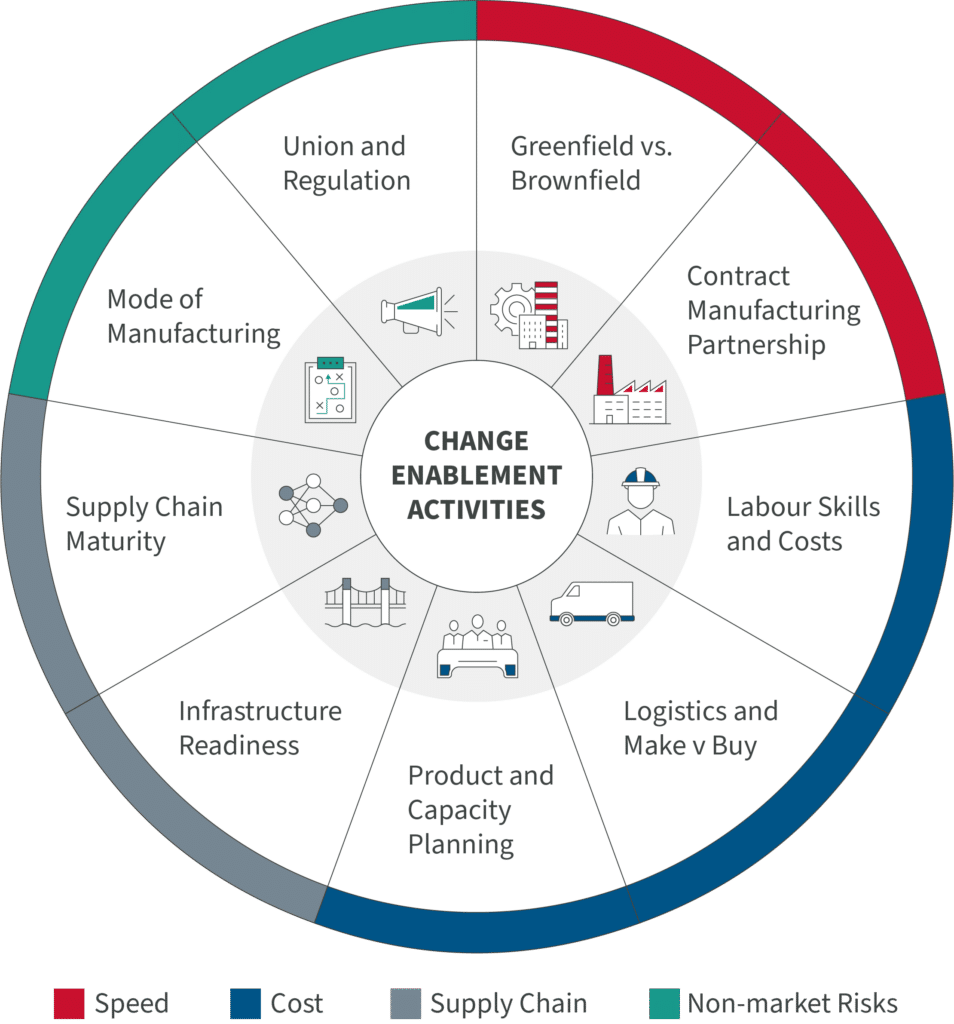

While one approach incoming EV makers could take is ‘sell in Europe, build in Europe’, a key challenge would be manufacturing footprint. Deciding this comes down to speed, cost supply chain and non-market risks.

Speed – Greenfield gives more control but Brownfield offers greater speed. But finding a contract manufacturing partner can be the speedier option with intimate knowledge of potential partners and structured negotiation.

Cost – Labour, logistics (inbound and outbound), parts costs (make or buy), and Capex (capacity investment) are a few key elements of the total cost equation. They need to be organically simulated for forecast and sensitivity analyses.

Supply Chain – Refers to both physical infrastructure like roads network and supplier network readiness. For example, Germany is known for being an automotive hub with a robust local supply chain. However, with transition into electrification, all the existing automotive supply chain faces a looming need to upgrade.

Non-Market Risks – To seal the win-win deal, localisation needs to be done in addition to numbers. There needs to be a strategy regarding labour unions. Rules of origin need to be evaluated for compliance beforehand. Alignment with local government on mode of manufacturing – assembly only, joint venture etc. – is also crucial.

02 – Supply chain strategy

While the supply chain is an important part of the manufacturing footprint decision, supply chain strategy is far more influential than a in input to manufacturing. Supply chain strategy sits in the control room for both supply base and customer base.

Localisation of sourcing: Deciding which parts to source locally and which remain global. As a start, there should be a total cost ownership approach, evaluating not only lead time and logistics improvement from local sourcing and pricing advantage from global sourcing.

Logistics Networks Optimisation: This covers both inbound network from supply base to factory, and outbound network from factory to customers. Creating a simulation of both time and costs of delivery routes and scenarios can inject confidence in this decision.

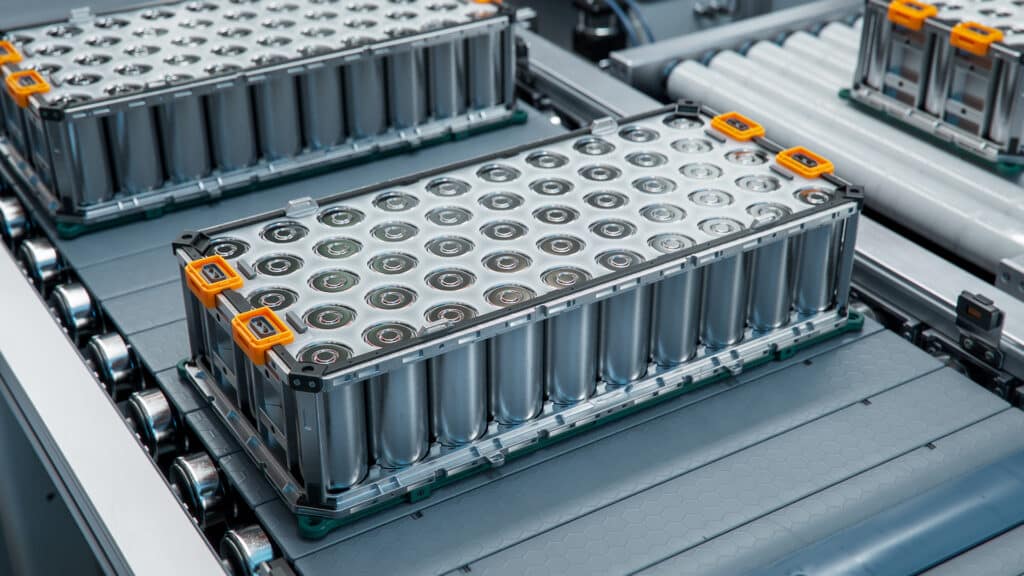

Battery Sourcing Strategy: Batteries represent 40%-50% of BOM cost. It’s cital to consider where, and from whom these should be sources as well as the best way to comply with rules of origin. If the local battery partner is different, its important to how should performance, quality risks and costs can be balanced and the best deal negotiated.

Regulatory Compliance: Pending final agreement on the potential increase in import tariff, Chinese EV manufacturers will always need to be on the watch for avoidance of punitive measures, while negotiating favourable treatment, with local governments or other EV schemes.

Carbon Footprint Assessment: As part of the evaluation of manufacturing location, operations and supply chain, carbon impact as well as costs needs a robust measurement. This calculation is still hard to standardise and require a high degree of customisation – what could accelerate it is a thorough methodology shortening the fact-finding.

Establishing a robust supply chain is crucial to Chinese EV manufacturers, providing the resilience needed to secure a foothold in the new market.

03 – Connection with the supply base

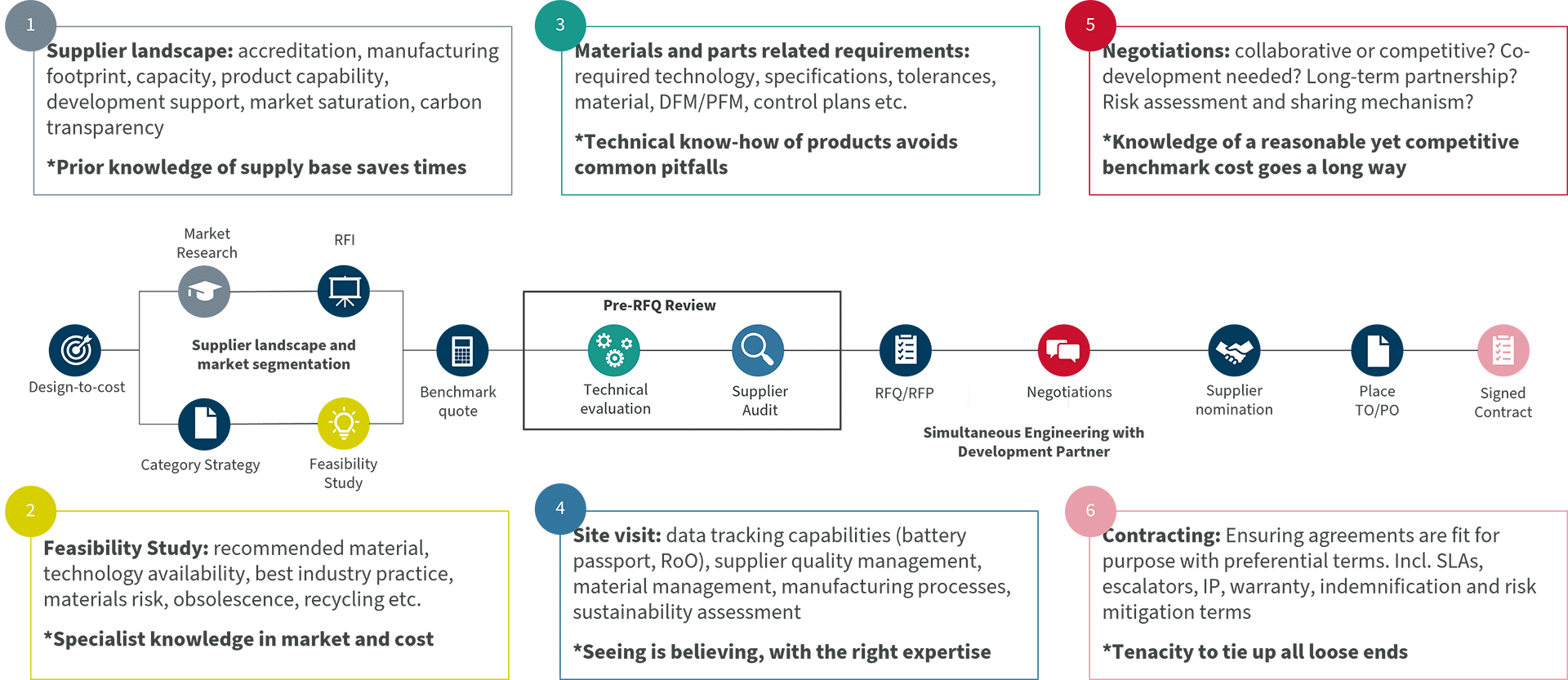

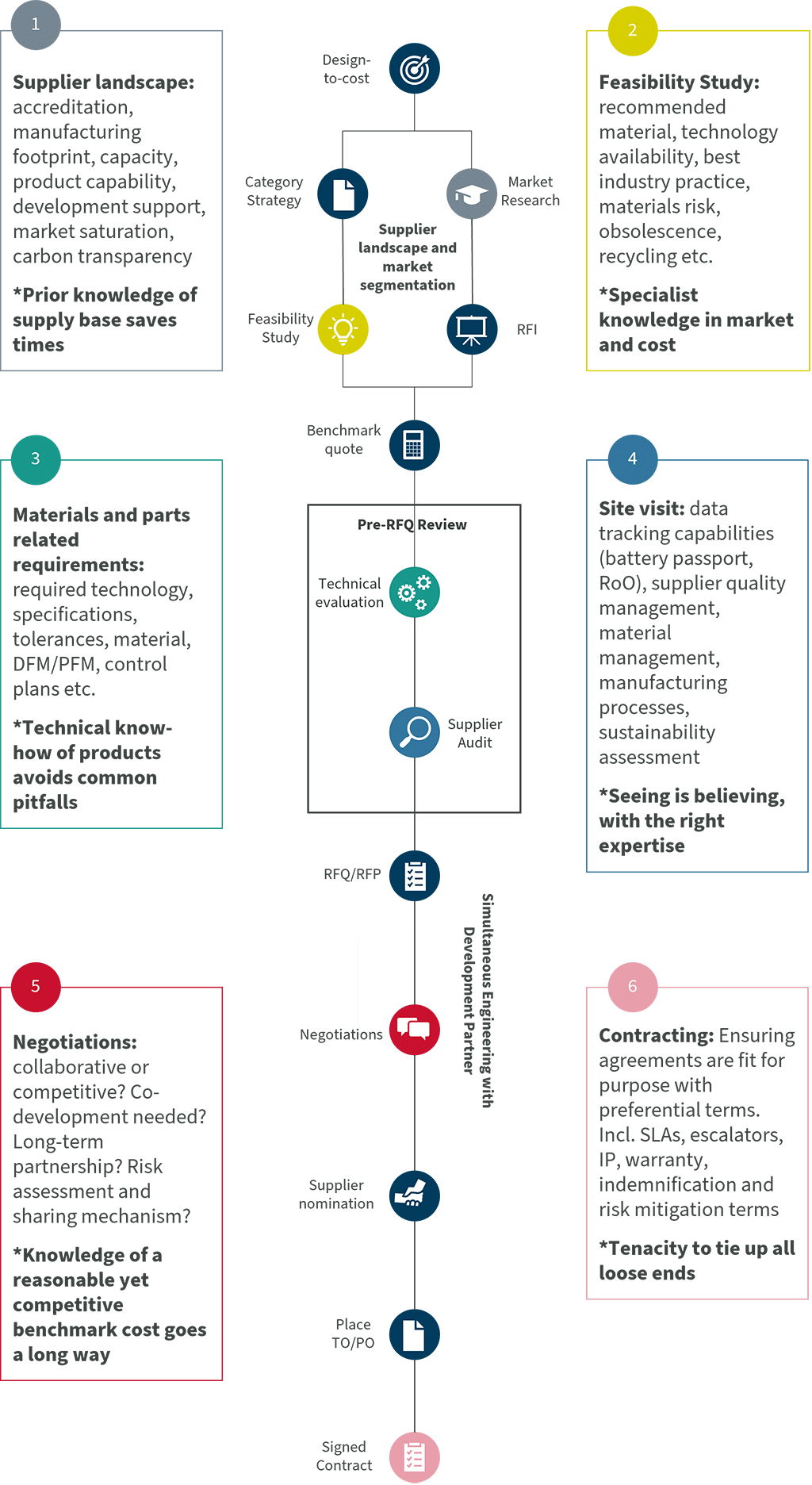

When the manufacturing footprint is set, and supply chain strategy is developed it’s important to establish relationships with the local supply base quickly.

To do this, EV makers need to have an efficient procurement process, sound market and cost knowledge as well as a willingness to cross cultural barriers.

Before rushing to market, consolidating cost ownership with market intelligence and category strategy can go a long way to delivering a competitive advantage.

Important considerations include:

• Whether the Bill of Materials (BoM) should remain exactly the same

• Which parts are to be sourced locally

• If it is better to make it or buy it

• What the trade-offs are between cost, quality and time.

Being able to answer questions with confidence, without disturbing the market, gives a lasting advantage – but it can’t be done without specialist knowledge in market and cost engineering.

The supply base then needs to be engaged. While it’s never a ‘one size fits all’, EV makers need a clear strategy to identify and engage reliable partners, assess risks involved, establish whether parts are off the shelf or if co-development is needed and determine how to accelerate conversation to converge on a competitive but also sustainable cost.

Speedy, Reliable Process to Connect with Supply Base

04 – Sales and aftersales network

While it could be argued that sales and aftersales completely different, from a strategy perspective there’s a striking similarity between them – the decision whether a business does it themselves or use a third party. In sales context, it’s about striking the balance between direct sales and dealership; in aftersales, it’s about balancing owned service hubs and third-party service network.

Overall, it’s a choice between quality, time, cost and complexity in order to earn and retain the hearts of customers. During an initial roll out of network, reliance on partnership networks often cannot be avoided in order to achieve the necessary speed and scale. It is crucial to execute such partnership immaculately – not only find, but also cultivate a reliable partner network.

Additionally, Chinese EVs have an additional nuisance to deal with – to further develop charging infrastructure for an extra boost in sales momentum. While this could take the form of partnership with an existing Charging Point Operators (CPO), ultra-fast charging or battery swapping is a defining USP for some of the brands (Xpeng ultra-fast charging, Nio battery swapping) making this more challenging. More internal investments may be needed, adding to the risks of the localisation.

Direct Sales

Control over quality: Full control over the sales process to provide a consistent customer experience

Customer loyalty: Manufacturers own direct relationship with customers and access to data insights to drive loyalty

Cost control: High initial investment in setting up, but savings can arise from elimination of commissions and fees, if the operational costs related to sales are controlled

Speed to scale: Slower to reach wider geographical areas, which may limit brand visibility

Management complexity: Control over an efficient sales process, technology and ops; however, building adequate internal capabilities can be challenging, risking customer trust

Dealership

Control over quality: Limited control on sales strategies which could lead to inconsistent customer experience

Customer loyalty: Limited influence over customer interaction, brand representation, or data insights

Cost control: Lower initial cost to set up operations, but higher operational cost from commissions and fees, requiring a robust scheme to generate savings

Speed to scale: With an established network, , dealership provide a quicker way to scale and expand geographical reach

Management complexity: Dealership offers local expertise and takes away some day-to-day operational burden for manufacturers to focus on product; however, interests must be well-aligned

Owned service hubs

Control over quality: Quality of service standards can be controlled to provide a consistent customer experience

Customer loyalty: Hubs own direct relationship with customers and access to data insights to drive loyalty

Cost control: Initial Capex investment is significant, while ongoing Opex for personnel and maintenance can be high; however, more control over cost savings

Speed to scale: Slow to set up each service hub, therefore limited in geographical reach

Management complexity: Managing multiple service hubs across countries may introduce complexity from logistics, ops and regulations

Third-party service network

Control over quality: Quality of service standards may vary, causing inconsistency in customer experience

Customer loyalty: Limited influence over customer interaction in a partner service network and access to data

Cost control: No upfront Capex cost, and Opex savings could be negotiated with partners upfront; however, less control on subsequent savings

Speed to scale: With an established network, , third-party partners provide a quicker way to scale and expand geographical reach

Management complexity: Complexity arises from managing potential conflict of interest – partners have a strong priority on profitability – and integration of systems

Win-Win Deal Challenge – A Way Forward

To create a win-win deal between Chinese EV and Europe the strategy of localisation needs to consider manufacturing footprint, supply chain modelling, connection with local supply base, and the development of sales and aftersales network. But situation continues to evolve.

European countries as well as various Chinese EV manufacturers have been making visible moves – notably UK has released favourable signals to Chinese EV, while BYD announced another factory in Turkey, followed by positive messages from other leading Chinese EV manufacturers. Driven by both domestic competition and aspiration to be a global leading brand, there’s no turning back for Chinese EV expansion overseas.

Therefore, it’s not a case of whether Chinese EV will come to Europe, but how, where, and when.

The current top three candidate locations for supply chain localisation of Chinese EV have been Germany, Spain and Hungary, representing different tiers of environment, from existing ecosystem, cost base and regulatory support angles. This picture will continue to evolve, based on decisions of incoming enterprises, local industry and governments.

But one critical aspect to test the success of localisation, is the replication of high productivity in Europe with local workforce. This is also the often-alluded to cultural barrier, since a key part of competitiveness of Chinese EV is in cost effectiveness, which stems from highly uniform community-first values and strong directive leadership. How this could be adapted with consensus-based leadership, and reconciled with traditions of labour unions and regulations, would have a lasting impact on sustaining the global dream of Chinese EVs.

Accelerate your electrification journey

Explore Vendigital