Walking the tightrope

In a difficult economic climate for both consumers and business, food and drink producers face a delicate balancing act to keep costs down while maintaining quality for customers.

Julie Neal is a Director and Consumer Products sector specialist at Vendigital. She recently shared her insights with Open Access Government.

Responding to a significant shift in consumer behaviour during the pandemic, many FMCG producers are exploring ways to develop greener processes and sourcing strategies. However, with the continued growth of online and discounter channels, careful cost management remains critical. So how should they go about it?

Green consumers

Over the past year, consumers have become more focused on buying green and concerned about the provenance of the goods they buy, sourcing locally where they can. At the same time, tightening environmental legislation in the push to achieve the Government’s legally binding target of net-zero emissions by 2050 is putting further pressure on businesses to turbocharge their own climate action plans.

Planning for a green transformation is a significant undertaking however and businesses need a whole-supply chain view of their operations in order to make changes that deliver on their strategic objectives, while also benefitting the planet. To remain viable, they also need to understand fully the operational impact and ensure there is sufficient demand for decarbonisation to justify the investment.

Highlighting the potential rewards for early-movers, a report published recently by the CBI, entitled ‘Seize the Moment’, sets out a cross-industry vision for a dynamic and future-focused economy, which focuses on innovation and winning the global race to net-zero. The report states that taking action to decarbonise operations could unlock growth opportunities worth £700bn for the UK economy by 2030.

Climate Change

If further evidence is needed that consumers care about climate change and expect products to be made and distributed in a way that is kind to the planet, an oft-cited study by Nielsen has found that 66% of global customers are willing to pay more for sustainable goods. During the pandemic, this willingness to pay more has led to an uptick in demand for goods sourced and supplied by smaller independent retailers such as coffee shops, farm shops, delis and specialist grocers.

Online shopping

At the same time, the rise in online shopping during the pandemic has buoyed sales for many larger e-commerce businesses too, not least the major supermarkets. Responding to heightened consumer awareness of the effects of climate change, many of the leading omnichannel retailers are placing greater focus on decarbonisation, with the introduction of initiatives designed to reduce their carbon footprint. As part of its 4Rs strategy to ‘remove, reduce, reuse and recycle’, Tesco has launched a scheme inviting customers to return soft plastics to recycling collection points at 171 stores across the UK. The supermarket also has plans in place to roll out the initiative to all stores nationally by the end of the year.

Case study: Co-op

The Co-op has recently launched a new climate plan, with the aim of offsetting all operational greenhouse gas emissions and being the first supermarket to sell fully carbon-neutral own brand food and drink by 2025. Explaining this action, Co-op Food’s CEO, Jo Whitfield, said ‘emissions from our operations and own brand products are where we have the greatest responsibility and can make the biggest difference’. The company is also calling for Government to make it mandatory for all businesses to report their full end-to-end greenhouse gas emissions.

Supply chain

End-to-end supply chain visibility is critical to reducing a product’s whole-life carbon footprint. Manufacturers need to look across the entire value chain – from the supply of raw materials, to manufacturing processes, distribution and waste minimisation through to the end consumer and beyond. It is only by peeling back the supply chain in this way that the real carbon drivers become apparent, allowing for the development of strategies to eliminate, reduce or mitigate them. In some cases, collaboration with suppliers can help manufacturers to decarbonise their operations and share the cost of doing so, particularly if investing in green technologies designed to reduce energy consumption or avoid the use of fossil fuels.

To assist in developing a roadmap to net-zero, manufacturers need improved visibility of accurate and reliable data, so they can complete detailed modelling of these complex factors and processes. They can then use this model to calculate the impact of their decisions across the value chain. As well as ensuring they achieve their sustainability objectives, such modelling could prove invaluable in accelerating the pathway to net-zero and securing a real competitive advantage.

Get in touch

Related Insights

In a difficult economic climate for both consumers and business, food and drink producers face a delicate balancing act to keep costs down while maintaining quality for customers.

Adopting operational excellence can help to achieve both short- and long-term goals across cost and carbon, creating competitive advantage and enabling more effective investment decisions.

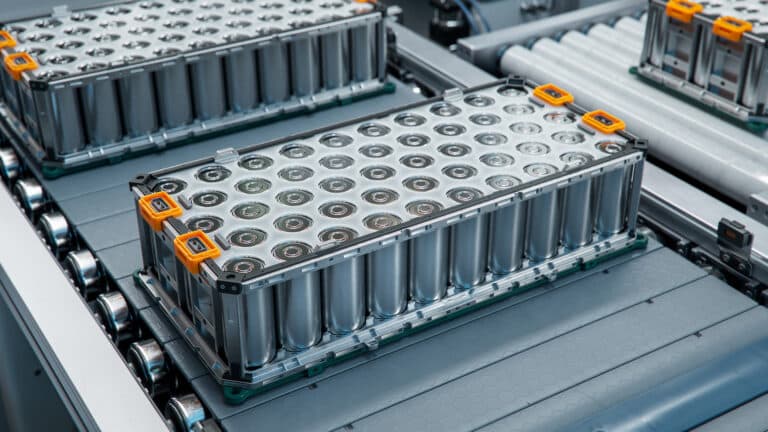

We share industry insights across aspects of EV Supply Chain, Battery Manufacturing and Circular economy including what businesses can do to create certainty around business growth.

Subscribe to our newsletter

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish. Read More

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| wpl_user_preference | vendigital.com | WP GDPR Cookie Consent Preferences | 1 year | HTTP |

| wpl_viewed_cookie | vendigital.com | This cookie stores information about your cookie consent state. | 1 year | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _gcl_au | vendigital.com | Used by Google AdSense for experimenting with advertisement efficiency across websites using their services. | 3 months | --- |

| __hstc | vendigital.com | Hubspot marketing platform cookie. | 6 months | HTTP |

| __hssrc | vendigital.com | Hubspot marketing platform cookie. | 52 years | HTTP |

| __hssc | vendigital.com | Hubspot marketing platform cookie. | Session | HTTP |

| _obid | vendigital.com | This cookie is set when a user lands on the site, containing a unique ID relating to the email that was clicked on. | 365 days | HTTP |

| _obid_visit | vendigital.com | This is used to identify a site session across multiple pages. | Session | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga | vendigital.com | Google Universal Analytics long-time unique user tracking identifier. | 2 years | HTTP |

| _gid | vendigital.com | Google Universal Analytics short-time unique user tracking identifier. | 1 days | HTTP |

| _gat_gtag_UA_29623111_7 | vendigital.com | Used to analyse visitor browsing habits, flow, source and other information. | Session | --- |

| IDE | doubleclick.net | Google advertising cookie used for user tracking and ad targeting purposes. | 2 years | HTTP |

| mp_a36067b00a263cce0299cfd960e26ecf_mixpanel | vendigital.com | Allow us to analyse how users use our site | 1 year | HTTP |

| _gcl_aw | vendigital.com | --- | 90 days | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| hubspotutk | vendigital.com | HubSpot functional cookie. | 6 months | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _GRECAPTCHA | www.google.com | Helps protect our clients and our systems from cyber spam and abuse. The information collected in connection with your use of the service will be used for improving reCAPTCHA and for general security purposes. It will not be used for personalised advertising by Google. | 6 months | --- |

| ppwp_wp_session | vendigital.com | --- | Session | --- |

| test_cookie | doubleclick.net | A generic test cookie set by a wide range of web platforms. | Session | HTTP |

| pnctest | vendigital.com | This is set by a third party library of Pubnub to test if cookies are supported by the browser. | 2 years | HTTP |

| traincalc | vendigital.com | Supports the UK Train Profitability Calculator advanced functionality | 3 months | HTTP |

| rs6_overview_pagination | vendigital.com | Cookie is set by Slider Revolution, tracks downtime and other browser related issues. | Session | HTTP |