Going beyond lean manufacturing

The UK’s aerospace industry has seen significant improvements in productivity but the truth is that much more could be achieved by accelerating the adoption of digital technologies and enriching the skills base.

In the midst of an industry-wide ramp up in production, many OEMs and Tier One manufacturers in the aerospace and defence (A&D) sector have been adding stock buffers to protect against supply chain delays and keep production lines moving. However, holding more stock has impacted inventory turn performance and eroded working capital – a situation that could now be holding many businesses back.

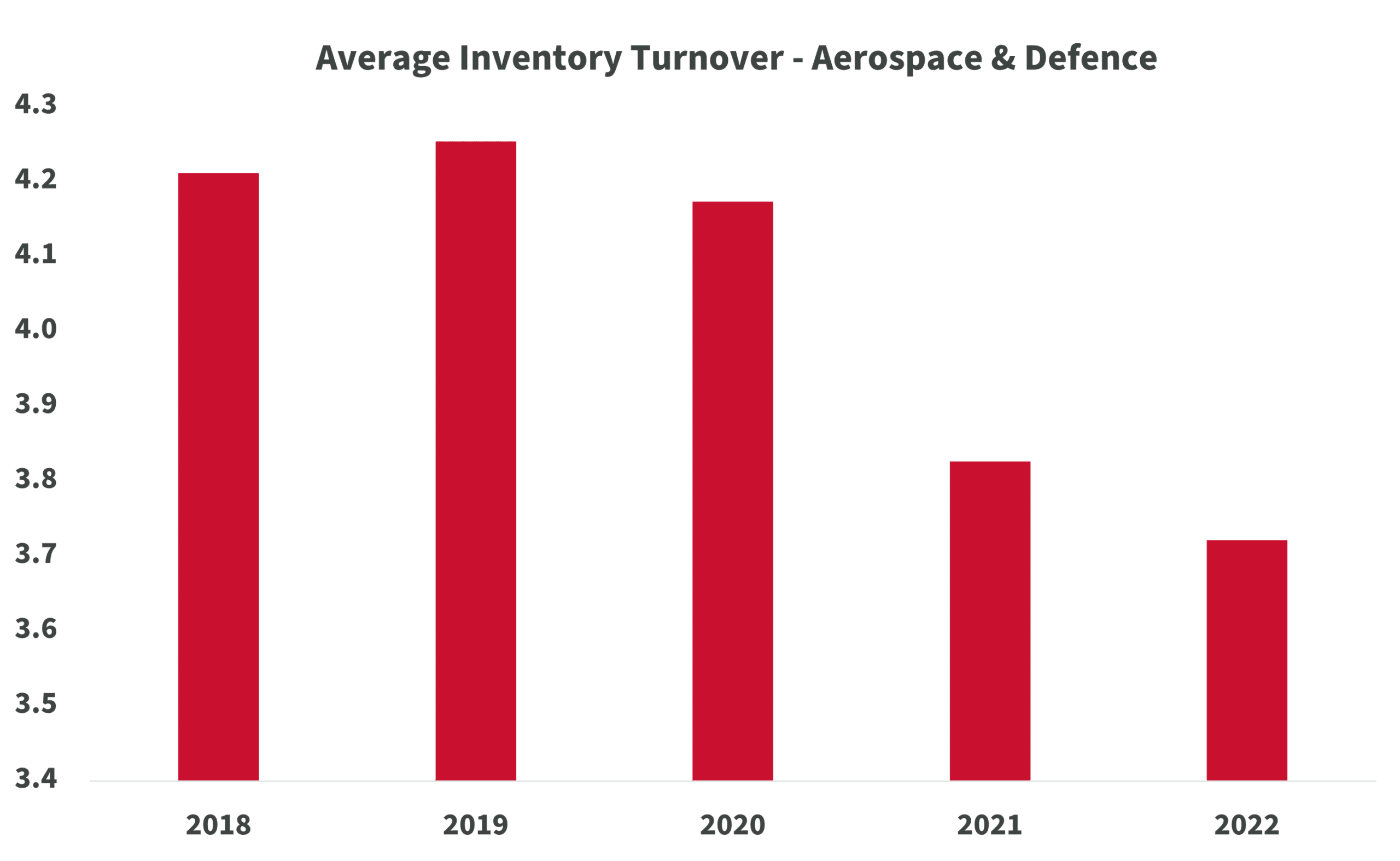

Our research shows that inventory turn rates dipped significantly when the production ramp up got underway following the Covid-19 pandemic, but supply could not keep up due to a series of challenging market conditions ranging from a volatile metal market through to a shortage of skilled workers. The average inventory turn rate for global A&D businesses was 3.7 in 2022, down from 4.2 in 2018. Bearing in mind that a healthy inventory turn rate is normally between 4 and 6 it is clear why inventory management has moved up the boardroom agenda. An analysis of the top 10 A&D businesses also showed that inventory turn performances varied significantly over the five-year period. Those with especially complex supply chains, which are geographically spread, saw the biggest falls in their inventory turn rate.

Feeling the ramp-up pressure

The ramp up in production in the A&D sector began in 2022 but is still very much underway today. Civil air passenger traffic is expected to exceed 2019 levels in 2024 and defence supply chains are ramping up to meet the demands of a more unstable geopolitical environment.

The complexity of global supply chains and decades of under investment in the sector have made it especially challenging for OEMs and Tier One manufacturers to increase production capacity in response to ramp up demands. Many have been forced to increase safety or buffer stocks to protect against supply chain shocks and delays, despite the impact this is having on working capital.

Asking the right questions

To improve inventory turn performance, OEMs and Tier One manufacturers must start by asking the right questions. This is because inventory is a symptom of business decisions and processes. For example, ‘how do I know if there is excess stock in the system?’ and ‘is it okay to reduce safety stocks?’

Identifying where excess stock exists and understanding its root causes can help manufacturers to address it confidently and take back control of operational efficiency. Data capture and analytics have a key role to play in unlocking inventory management understanding and helping businesses to make better-informed decisions.

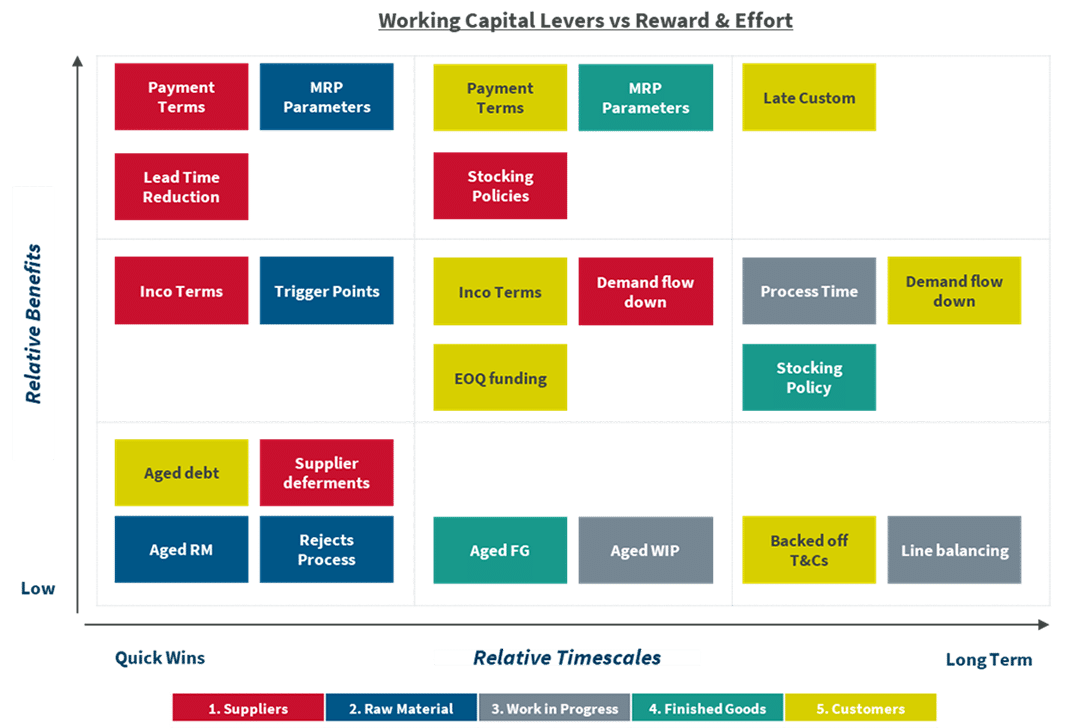

Bespoke models built on real-time data can help businesses to differentiate between unintentional and intentional inventory and see where there is scope for reduction. For enhanced visibility, models are built using data sourced from end-to-end supply chains, combined with cross-functional business and third-party data. As well as spotting opportunities to reduce inventory, managers can use these data-based models to select which working capital levers to pull that will bring them the best rewards in the shortest time

Using data-based models

Excess inventory is often put down to poor planning, but it can be a systemic problem. By taking a holistic, data-led approach to inventory management across end-to-end supply chains, manufacturers can identify the root causes. For example, a lack of communication between the sales and scheduling teams or poor information management could be skewing demand data or rendering it invisible. Getting to the nub of the problem will enable the business to take action to prevent excess or unintentional inventory in the future. Common root causes of excess inventory include:

The root causes of excess inventory may be contributing to poor operational decision-making, which could be eroding both profit margins and working capital. The cost impact of these decisions may not be fully understood. For example, reduced profit is easy enough to quantify, but the erosion of working capital has an additional cost in terms of a lost opportunity to invest in new equipment or other value-driving initiatives.

Addressing the root cause

The drive to fulfil orders on time during a production ramp up could force OEMs and Tier One manufacturers to consider stockpiling product. While reviewing processes at a factory recently, our project team found that ready-to-ship product was being stockpiled to facilitate on-time deliveries. Poor visibility had led managers to take this action, even though keeping more finished product had dented working capital significantly. By developing a data-based model to analyse inventory across the end-to-end supply chain, the business was able to reduce ready-to-ship stock while continuing to meet on-time delivery demands. The changes also released pressure on working capital.

In the defence sector, the production rate ramp-up has led to a ‘war of the warehouses’ as manufacturers rush to increase floor space to stockpile ammunition, weapons and drone equipment. This approach is driving up costs significantly and eroding working capital. By applying inventory analytics, manufacturers could improve control at each stage of the production process and release unwanted floor space.

The legacy nature of the aerospace and defence industries makes it more challenging for OEMs and Tier One manufacturers to tackle problems at the root cause. By placing their trust in reliable, data-based models and focusing on improving inventory turn performance, there is an opportunity to reduce costs, alleviate pressure on working capital and increase enterprise value.

Take control of your costs – book a 30 minute slot with one of our cost transformation experts

Combining over 20 years of experience, delivering cost and value engineering to multiple businesses, our team have been able to make cost savings and build supply chain resilience.

We’ve helped to transform our customers’ cost base whilst managing their margins in challenging times.

We also won the 2024 Silver Medal in the Aerospace and Defence category for the Financial Times Leading UK Management Consultants special report, recognising the work we do for our customers such as Marshalls Land Systems and Meggitt.

Want to learn more about how Vendigital can help your business? Book a 30-minute consultation with one of our Aerospace & Defence specialists today and get your business ready to ramp up.

Sign up to get the latest insights from Vendigital

Related Insights

The UK’s aerospace industry has seen significant improvements in productivity but the truth is that much more could be achieved by accelerating the adoption of digital technologies and enriching the skills base.

Manufacturers need to collaborate closely with suppliers to mitigate the impact of shocks and supply chain disruptions.

The boom in Generative AI is creating new opportunities for aerospace and defence sector manufacturers. Used correctly, GenAI capability can help to optimise production processes, improve supply chain resilience, ringfence knowledge and reduce costs.

Subscribe to our newsletter

Take control of your costs – book a 30 minute slot with one of our cost transformation experts

Book a free, no-obligation 30-minute consultation with one of our cost transformation experts to discuss your current operational challenges, specific ambitions and explore tailored strategies to achieve your cost reduction goals.