Increasing capacity and meeting decarbonisation goals – can it be done?

We discuss the cost and infrastructure considerations of switching to an all-electric fleet of off-highway vehicles.

Justin Benson is a Partner and Automotive sector specialist at Vendigital. He recently shared his insights with E&T.

New electric vehicle platforms are springing up across the UK, some led by established players, others the work of entrants to the market. Can the newcomers compete?

The electric vehicle market in the UK is expanding rapidly, with more than 190,000 new battery electric vehicles (BEVs) sold last year, despite the government’s decision to cut grants. With demand set to increase further – ahead of a planned ban on the sale of new internal combustion engine (ICE) vehicles in 2030 – consumers are eagerly awaiting more options to choose from.

Focusing on the commercial vehicle space, UK-based newcomers such as Tevva and Volta are planning to release new all-electric trucks and passenger vehicles to the market in 2022. Other well-funded up-and-coming companies are developing world-class technologies that are now approaching EV market readiness. Will their new offerings make it to market in time to capitalise on the rapid uptick in demand?

For new entrants, the route to market poses more risks than it does for legacy automakers, who – as well as benefitting from an established customer base and strong market understanding – have the production and procurement know-how to launch new platforms. New entrants, on the other hand, may lack the capabilities needed to build robust supply chains and design high-value products for manufacture.

With so many new EVs planned for release in 2022, manufacturers are increasingly looking for ways to differentiate their products. Some are opting for unique designs that bring lifestyle benefits, such as Canoo’s electric pickup which converts into a campervan. At the upper end of the market, Tesla’s futuristic cybertruck has a distinctive, angular body shape that is likely to appeal to urbanites. The more radical the aesthetic, however, the higher the risk that consumers might not like what they see.

Despite the rapid growth in EV registrations in the UK, the lack of charging infrastructure remains a barrier to mainstream consumer adoption. The ratio of public charging points to plug-in vehicles fell by almost a third in 2020, according to the Society of Motor Manufacturers and Traders. This means the gap in available infrastructure is widening rather than closing. The government’s decision to require all new homes and businesses in the UK to have EV charging stations in 2022 should help to improve the situation by adding up to 145,000 extra charging points each year.

With demand for all-electric vehicles in the UK forecast to hit 300,000 this year, manufacturers can’t afford to delay in bringing their products to market, particularly those that could have more mainstream appeal. However, to compete successfully in the long term, new entrants must balance the need to prioritise speed to market with the value-driving benefits that come from achieving a vertically integrated business model.

Among the ways that legacy automakers and new entrants can optimise value is to focus on best practice management principles, such as staying close to customers and design-to-cost engineering, which involves setting the right cost and designing the product for manufacture from the outset. Considering EV architecture as a whole, and understanding the effect that trimming cost in one area might have on the product’s overall performance and attractiveness, can help manufacturers to mitigate risk by optimising efficiency and eliminating the need for costly fixes further down the line.

As the EV market evolves, other opportunities to drive efficiency and value could come to light and manufacturers should be prepared to act quickly. For example, some automakers, such as Ford and VW, have opted to collaborate and share EV platforms. While this brings them opportunities to realise synergic efficiencies, it could also increase the risk of losing EV market share. Others have focused on securing a reliable battery-supply partner as more domestic Gigafactory production comes online – this could be crucial as production volumes increase.

Going forward, there could be opportunities for OEMs to outsource their dealership and maintenance and repair networks to a single supplier. Constellation Automotive’s decision to offer £201.6m for a controlling stake in Marshall Motor Group in November 2021 shows that there is significant appetite for consolidation at this end of the market. For EV makers, tapping into these emerging one-stop-shop service offerings could allow them to focus resources on manufacturing and driving productivity.

As they compete for market share, new entrants and established players alike will need to have the right resources in place at the right time. Before taking a decision to scale up production, they need to be sure where value exists and target resources in the right areas. They should also be prepared to manage resources flexibly in order to meet peaks in demand. For example, more resources might be needed when establishing strategic supply partnerships for the first time, but once that is done they could be redeployed to support the next tranche of production.

Whatever value new entrants are able to secure now could serve them well as the EV market matures and global demand begins to contract. There will also be significant near-term challenges. For example, no one knows exactly how consumer behaviour and attitudes will shape demand. We could see more single-car households as individuals explore other mobility options or look for ways to reduce the cost of ownership. With so many imponderables, legacy automakers and new entrants will have to be ready for anything.

Sign up to get the latest insights from Vendigital

Get in touch

Related Insights

We discuss the cost and infrastructure considerations of switching to an all-electric fleet of off-highway vehicles.

EV makers in the UK and Europe are warning that Zero Emission Mandates are simply not doable and subdued levels of demand could force them to close factories. Should the industry embrace Chinese capability before it’s too late?

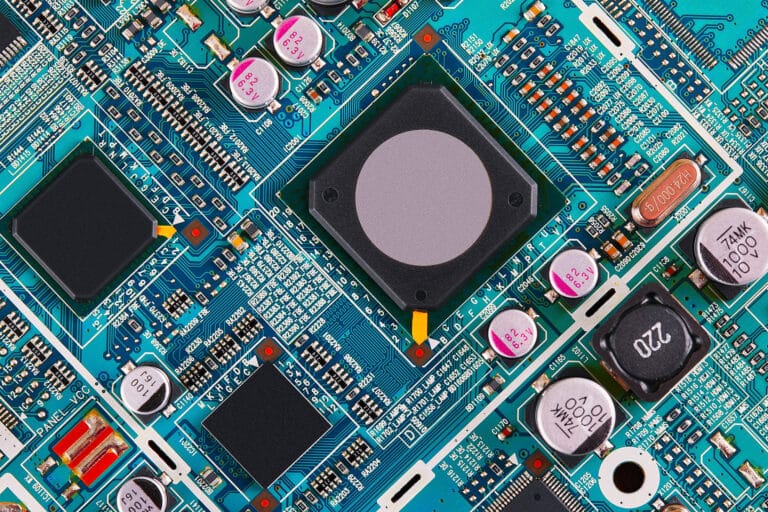

In our latest report we examine the impact of power electronics and the importance of inverters in EV manufacturing.

Subscribe to our newsletter