Increasing capacity and meeting decarbonisation goals – can it be done?

We discuss the cost and infrastructure considerations of switching to an all-electric fleet of off-highway vehicles.

Dominic Tribe is a Director and Automotive sector specialist at Vendigital. He recently shared his insights with Engineering & Technology.

The prospect of an extended armed conflict in Ukraine means manufacturers of electric vehicles need as a matter of urgency to find alternative and sustainable sources of vital raw materials and components.

Following Russia’s invasion of Ukraine, the race is on for electric vehicle manufacturers, OEMs and their suppliers to find a solution to the critical supply shortages that are already impeding the production of battery-electric vehicles in Europe and the US.

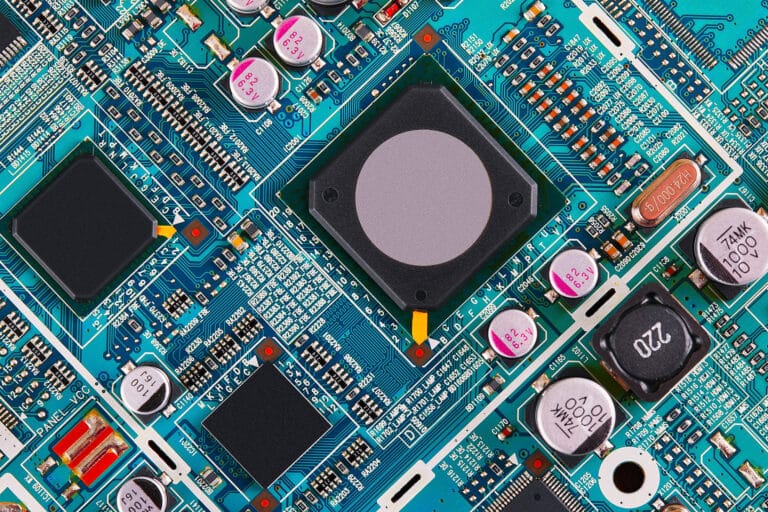

Car makers and EV platforms are desperate to establish alternative sources of supply for some components, which would typically come from production plants in Ukraine. Makers of EV batteries and semiconductors are also vying for supplies of vital raw materials, such as palladium and nickel, as well as noble gases such as neon, which are typically sourced from Ukraine.

About half of the world’s supply of semiconductor-grade neon is sourced from two Ukrainian companies, Ingas and Cryoin. The gas is a by-product of the separation processes used to make nitrogen for use as a fertiliser for the country’s vast arable farming industry. Grade 5.0 Neon is a vital component of the high-power pulsed lasers used to make microchips, and concerns are growing that significant supply disruption could exacerbate current global supply shortages and further disrupt the production of EV batteries.

Many other raw materials, typically sourced from Russia, are required for use by key EV suppliers, and prices have risen sharply since the Ukraine war began. For example, Russia is responsible for 38 per cent of the world’s supply of palladium, which is used in the production of catalytic converters, semiconductors and many electrical parts. Russia also mines nickel used to make car batteries. Both commodities have seen prices rise to record levels recently, and the London Metal Exchange suspended the trading of nickel for a spell earlier this month when the price rose above $100,000 per tonne.

The sustainability of supplies of low-cost components made at plants in Ukraine, some close to the Polish border, are another cause of concern. These factories are involved in the production of parts such as wiring harnesses, which can’t be sourced elsewhere. EV makers such as BMW and VW have been forced to reduce production output due to shortages of these components.

While the main focus in the short term is on finding a satisfactory workaround to supply-chain challenges, the prospect of an extended armed conflict in Ukraine means manufacturers must also look for more sustainable alternatives. The problem is that some raw materials can only be found in specific regions of the world, so finding an alternative source of supply may not be possible. Nickel, for example, is a finite resource that is found in Russia and China, so switching to a Chinese source of supply could be an option. However, realistically, it could take five years or more to get a new mine operational to meet the needs of the fast expanding global EV industry.

If Ukraine-based facilities survive the conflict, time may be needed here too to reinstate a skilled workforce and resume pre-invasion production levels of wiring harnesses and other components. For many EV makers and OEMs, the only option in the short to medium term may be to slow down or halt production.

The only viable solution for the industry in the longer term will be to configure supply chains with geopolitical risk in mind. Of course, quality and service will remain important procurement criteria, but supply chain resilience is now firmly at the top of the boardroom agenda. Flexible production schedule management systems, capable of providing more accurate demand forecasts, can help to optimise output and ensure profitability as manufacturers adapt to supply disruption. They can also help in supply negotiations and securing allocation of parts.

The longer the conflict in Ukraine continues, the more market forces could create opportunities for some suppliers. With output constrained, suppliers of much-needed raw materials or components will be able to pick and choose which customers to service, and they are likely to select those where they can generate the biggest margin. For some raw materials, such as nickel, increased market competition could favour EV manufacturers, who tend to pay a higher price than stainless steel producers, whereas semiconductor manufacturers are more likely to favour consumer electronics companies committed to larger volumes. Disrupted supplies at any level of the supply chain are more likely to benefit established car makers, such as Ford, which has set a goal to sell more than two million EVs globally by 2026, over higher-risk EV start-ups.

Improved connectivity could help EV makers to ring-fence vital supplies by giving them greater visibility of inventory levels across the supply chain, so they can optimise output to parts availability. It could also enable them to respond to supply disruption in a more agile way. For example, a business sourcing wheels from two suppliers in different regions – forged wheels from Taiwan and cast wheels from Europe – could switch between the two according to what they have available at the time, as long as there is consumer demand.

With so much uncertainty about the outcome of the Ukraine conflict, the EV industry must plan ahead with caution. Interim strategies introducing greater supply chain visibility and production system agility will be vital in the short term. In the longer term, EV makers will need to sponsor more innovation to develop sustainable alternatives, which will reduce their reliance on finite resources and components from high-risk regions of the world.

Sign up to get the latest insights from Vendigital

Get in touch

Related Insights

We discuss the cost and infrastructure considerations of switching to an all-electric fleet of off-highway vehicles.

EV makers in the UK and Europe are warning that Zero Emission Mandates are simply not doable and subdued levels of demand could force them to close factories. Should the industry embrace Chinese capability before it’s too late?

In our latest report we examine the impact of power electronics and the importance of inverters in EV manufacturing.

Subscribe to our newsletter