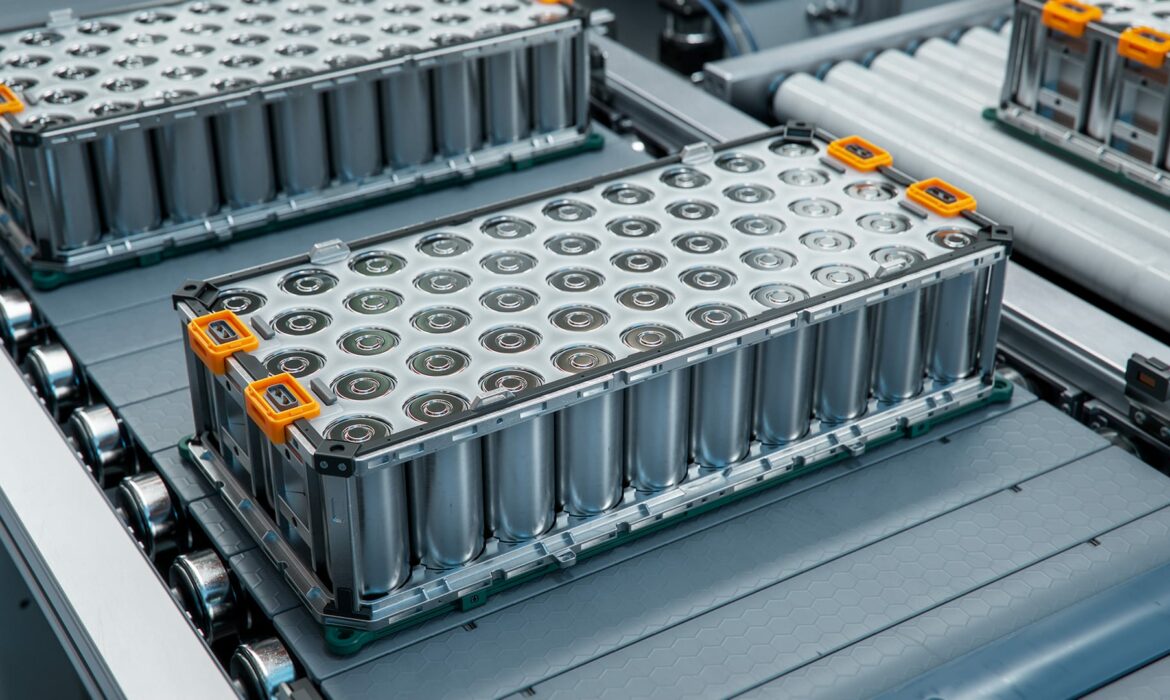

The AI advantage: get ready for battery passports

With greater transparency comes greater responsibility to ensure the supply chain is operating ethically and sustainably.

FMCG manufacturing – data visibility is key to cost and carbon efficiency

An accurate and holistic understanding of the carbon and cost impact of each facet of business operations is imperative to stay competitive.

Where have all the EV incentives gone?

When it comes to deciding whether or not to buy a new battery electric vehicle (BEV), limited access to accurate and reliable user data, as well as a lack of incentives, are holding back sales.

Bringing innovation to life

With product innovation flourishing, manufacturers could be forgiven for innovating first and thinking about whether their value chain is capable of bringing it to market later. Yet taking this approach could be selling themselves short.Using should cost modelling strategies to absorb rising costs

Should Cost modelling can accelerate cost savings, closing the cost gap that often exists between the business environment of months or even years ago, compared to that of today.

PE firms are back in investment mode and sharpening their focus on value creation

An upturn in private equity investing seems to be underway. But with multiples constrained and exits continuing their slow recovery, managers are sharpening their focus on value creation.

Is poor inventory turn performance holding your business back?

In the midst of a ramp up in production, many manufacturers have been adding stock buffers. However, holding more stock has impacted inventory turn performance and eroded working capital.

Making the most of the ramp-up opportunity

This report sheds light on the challenges many businesses are facing as production rates increase. Key to their success is balancing the need to improve operational performance while optimising supply chains.

What should it cost? The role of good data

Should Cost modelling is a crucial practice in many industries. However, the key to successful Should Cost modelling is the availability and accuracy of good data.